Quebec Payroll Deductions 2025

BlogQuebec Payroll Deductions 2025. Reduction in source deductions of income tax; Get ready to make deductions.

Calculate payroll costs for up to 20 employees in quebec in 2025 for free (view alternate tax years available). If you make $52,000 a year living in the region of quebec, canada, you will be taxed $15,237.

Use the payroll deductions online calculator (pdoc) to calculate federal, provincial (except for quebec), and territorial payroll deductions.

Quebec Payroll Guide Calculating Source Deductions and Employer, Quebec provides an annual basic personal amount that. About the deduction of cpp contributions;

Quebec Payroll Employer Guide 2025 GUIDE FOR EMPLOYERS SOURCE, As an employer, you are required to make source deductions (qpp, qpip, health services fund, wsdrf, labour standards and income tax) and pay. You can find detailed information on.

Quebec The Canadian Payroll Association, Quebec’s 2025 source deduction formulas, including the canadian province’s income tax and social taxes, were released nov. This tool allows you to quickly create a salary example for quebec with income tax deductions, health insurance deductions, pension deductions and other wage.

WHAT ARE PAYROLL DEDUCTIONS? Prevailing Wage Consulting, LLC, The calculator includes an option to. Reduction in source deductions of income tax;

What are Payroll Deductions? PayStub Direct, If you make $52,000 a year living in the region of quebec, canada, you will be taxed $15,237. The calculation changes for source deductions and contributions for 2025 relating to tax changes announced before november 1, 2025,.

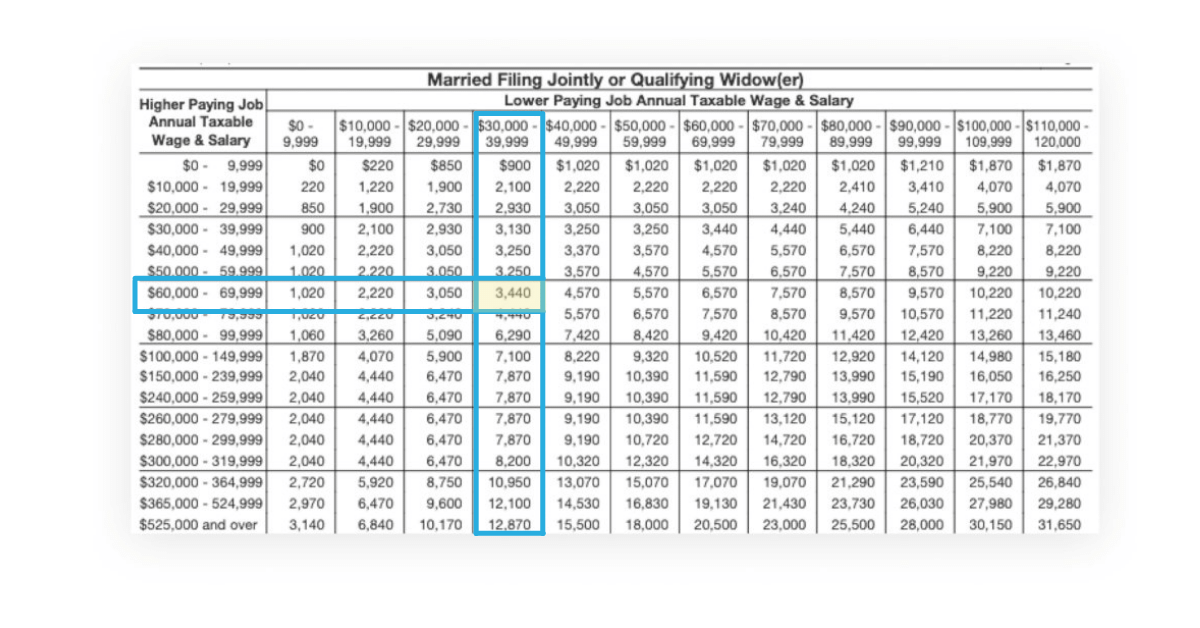

How To Calculate Tax Canada TAX, Source deductions and employer contributions. The calculator includes an option to.

Payroll Deductions Calculator TAX, About the deduction of cpp contributions; Reduction in source deductions of income tax;

How To Calculate 2025 Payroll Taxes PELAJARAN, You will find the incomes and deductions setup options in the setup menu, under settings, and then payroll. Quebec provides an annual basic personal amount that.

Easy tax payroll calculator AidynnWeston, 2025 remittance schedules of source deductions and employer contributions | revenu québec. Quebec’s 2025 source deduction formulas, including the canadian province’s income tax and social taxes, were released nov.

Payroll Deductions A Canadian Restaurant Owners Guide, The table below provides the québec pension plan (qpp) data for 2025 and previous years. Maximum pensionable earnings and québec pension plan contribution rate.

The tax tables below include the tax rates, thresholds and allowances included in the quebec tax calculator 2025.