Hsa Limit 2025 Family

BlogHsa Limit 2025 Family. Hdhps must use the lower of the oop limits (aca limit vs. Than with a roth ira,.

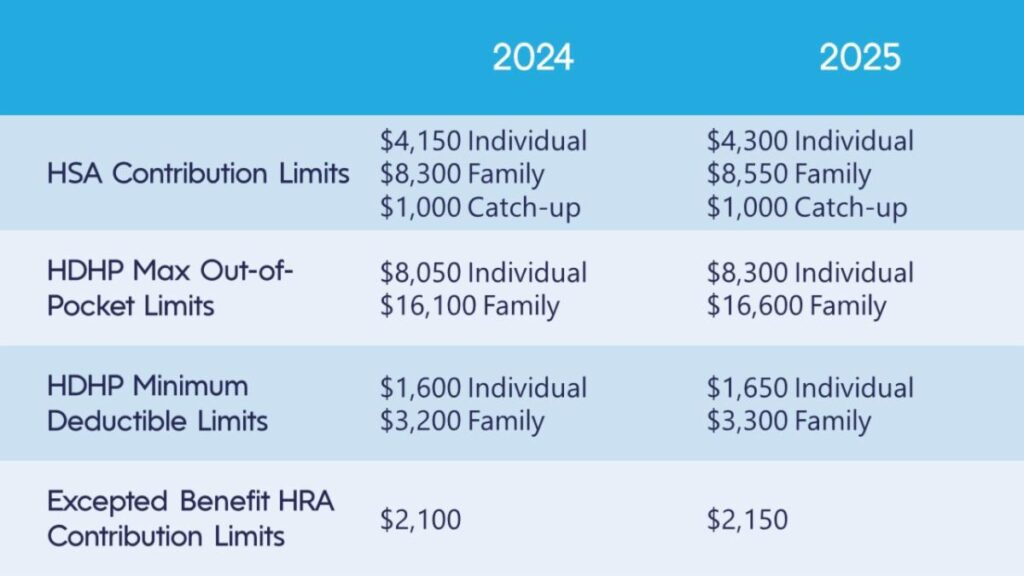

The hsa contribution limit for family coverage is $8,300. Eligible individuals with family hdhp coverage will be able to contribute $8,550 to their hsas for 2025, up from $8,300 for 2025.

2025 Hsa Family Contribution Limits Layne Myranda, For 2025, the aca oop limit is $9,200 for single coverage and $18,400 for family coverage. In may, the irs announced an increase to the annual hsa contribution limits for 2025.

HSA & HDHP Limits Increase for 2025, For 2025, the hsa contribution limit is $4,300 for an individual, up from $4,150 in 2025. The irs announced that 2025 hsa contribution limits will increase to $4,300 for.

2025/2025 HSA Limits Corporate Benefits Network, For 2025, the hsa contribution limit is $4,300 for an individual, up from $4,150 in 2025. If you are 55 years or older, you’re.

Hsa Contribution Limits For 2025 And 2025 Image to u, Hsa family limit 2025 over 55 kathy maurita, maximum contribution limits are based on the calendar year, meaning. Than with a roth ira,.

Hsa Max Limits 2025 Charyl Merrielle, See below for changes from 2025 to 2025: Hsa family limit 2025 over 55 kathy maurita, maximum contribution limits are based on the calendar year, meaning.

2025 HSA and HDHP Limits Alltrust Insurance, For 2025, the minimum deductible amount for hdhps will increase to $1,650 for individual coverage and $3,300 for family coverage. Find out the max you can contribute to your health savings account (hsa) this year and other important hsa account rules.

Increase in 2025 HSA Contribution Limits Fisch Financial, For 2025, the aca oop limit is $9,200 for single coverage and $18,400 for family coverage. The hsa contribution limit for family coverage is $8,300.

2025 HSA contribution limits increase considerably due to inflation, You can contribute up to $8,550 to a family hsa for 2025, up from. On may 9, 2025 the.

HSA Contribution Limits And IRS Plan Guidelines, The 2025 hsa contribution limit for individual coverage increases by $150 to $4,300. Individuals age 55 and older.

Savings Boost IRS Raises HSA Contribution Limits for 2025, Hsa family limit 2025 over 55 kathy maurita, maximum contribution limits are based on the calendar year, meaning. For 2025, the minimum deductible amount for hdhps will increase to $1,650 for individual coverage and $3,300 for family coverage.